- Author: Raymond

- Category: Motorcycle Insurance in Kenya

Common Types of Motorcycle Insurance in Kenya

Motorcycle insurance in Kenya isn’t just paperwork; it’s your lifeline when things go sideways. Many riders learn that the hard way after an accident — like Kevin’s case where he was riding a private motorcycle but carried a passenger. So, let’s break it all down: the types, the cover differences, and what happens when a private bike rider crosses the line into “boda boda territory.”

Motorcycle insurance in Kenya generally falls into three major categories, regulated under the Insurance Act Cap 487. Here’s the lowdown:

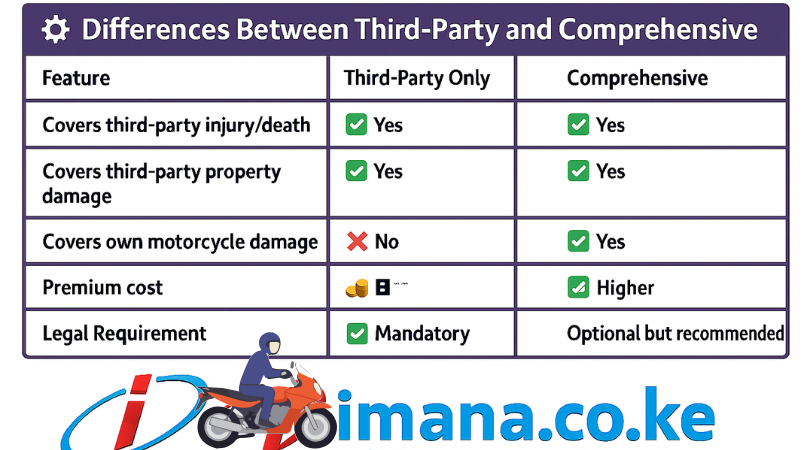

1. Third-Party Only (TPO)

This is the minimum legal requirement under Kenyan law.

It covers:

- Bodily injury or death to third parties (like pedestrians or other motorists).

- Damage to third-party property (e.g., another person’s vehicle or fence).

👉 It doesn’t cover your own bike. If your motorcycle gets damaged, you pay out of pocket.

2. Third-Party, Fire & Theft (TPFT)

This is a step up from TPO. It covers:

- All TPO benefits, plus:

- Fire damage to your motorcycle.

- Theft of your motorcycle.

3. Comprehensive Cover

This one’s the big boss — the “I sleep better at night” kind of policy.

It covers:

- All Third-Party risks.

- Damage to your own motorcycle after an accident.

- Fire, theft, vandalism.

- Optional add-ons like personal accident cover, excess protector, political violence, or rider’s gear protection.

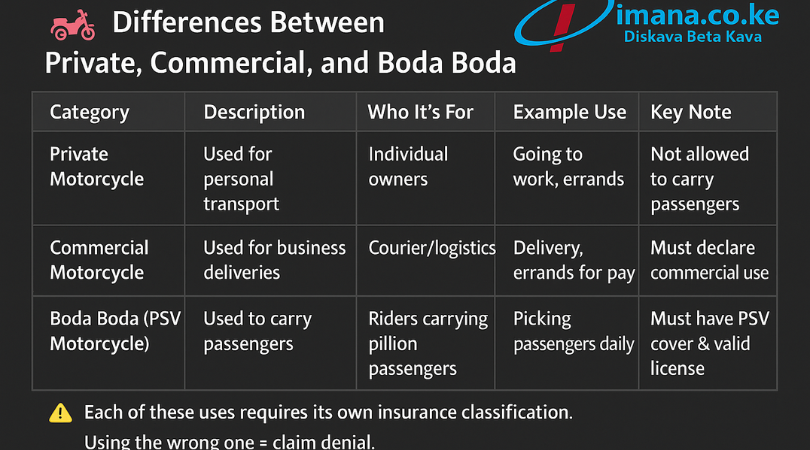

🚨 Kevin’s Scenario — Private Comprehensive but Passenger Onboard

Kevin’s motorcycle has a private comprehensive cover, meaning it’s insured for personal use only, not for carrying passengers for hire or reward.

When Kevin decides to carry a pillion passenger and hits a matatu:

- The passenger becomes a third party, yes — but under policy exclusion, private motorcycles are not authorized to carry passengers (unless specified).

- Because he violated the policy terms (misuse of the insured vehicle), the insurance company has the right to reject the claim.

- That means:

- The injured passenger can sue Kevin personally.

- The insurer may decline to repair his bike or pay the third-party injuries since he was in breach of policy use.

So — in this case, Kevin’s insurer will most likely not pay.

If he had a commercial or boda boda insurance cover, it would have been a valid claim.

👉 Each of these uses requires its own insurance classification.

Using the wrong one = claim denial.

🧭 Insurance Wisdom

Insurance isn’t just about paying premiums — it’s about honesty in usage. Kevin’s case is a classic example of policy misuse leading to non-payment.

Always disclose how you intend to use your motorcycle to your insurer or agent — like Imana Insurance Agency Kenya Ltd, who’ll help you pick the right cover (Private, Commercial, or PSV/Boda Boda) from trusted partners.

🌐Imana Insurance Agency Kenya Ltd

📍 4th Floor, Krishna Centre, Woodvale Grove, Westlands, Nairobi

📞 Call/WhatsApp: +254 796 209 402 / +254 745 218 460 / +254 113 806 810

💻 Visit: www.imana.co.ke | www.mykava.co.ke

Motorcycle insurance Kenya, boda boda insurance, private motorcycle insurance Kenya, PSV motorcycle cover, third-party motorcycle insurance, comprehensive motorcycle insurance Kenya, insurance claim denied, Imana Insurance Agency Kenya, compare insurance quotes Kenya, buy motor insurance online Kenya

#MotorcycleInsuranceKenya #BodaBodaCover #ComprehensiveInsurance #ThirdPartyInsurance #ImanaInsurance #MyKavaInsurance #CompareBuySave #InsuranceClaimsKenya #PrivateMotorcycleCover #PSVInsuranceKenya #KenyanRiders #InsuranceMadeEasy